The 1st quarter is now officially over and what a quarter it has been so far! The stock market rise which started with the Santa Rally did not look back and kept rising. The bear camp including many famous names have been obliterated and ridiculed. But it was a rally which nobody loved. The bears hate it because it destroyed them. Bulls hate it because they were not fully prepared for it and could not get enough of it. Those on the sideline hate it because they never got a chance to join it after a pull back. Because there was no pull-back.

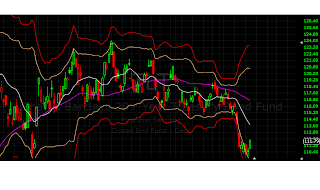

While I correctly predicted the start of the rally, I jumped down too early based on Technical Analysis while my cycle analysis and fund flow analysis were still positive. But in the Fed manipulated world no TA or fancy chart works. To get an idea of how the stock market really works just take a look at the following chart.

Do we need anything else to beat the stock market?

Question is where we go from here. The answer possibly lies in the Fed action as well. The Operation twist is ending in June and there is no sign of more free money as yet. Combine the need of the Banksters with that of the politicians and we will get an answer which is fairly close. The Presidential election campaign will kick off in earnest from June. If there is no further liquidity pumping, the stock market will surely decline. If the stock market does not do well, that is bad news for an incumbent president. So the Banksters and TBTF banks want more free money without which they cannot keep the ponzi scheme going and Obama need the Wall St. to keep pumping the stocks to get re-elected. There is no chance that the stock market will be allowed to perform on its own free will based on fundamentals till November. Bernanke has no option but to provide free money to the Wall St. even when he is aware that ZIRP is destroying the country and excess liquidity needs to be drained. They are boxed in a corner. (This is my theory and I may be wrong).

You may ask that if the above is correct and Operation Twist is still in operation why then the stock market should ever correct even remotely. Once again it is a matter of timing. If the stock market continues to operate at this present level till June / July, what justification Bernanke will have to pump more money. And if the stock market tanks in July / August, it may be too late to repair the damage from Obama re-election standpoint. So they have to start pumping the market again at least from the beginning of the 3rd quarter to have meaningful and positive impact on consumer confidence and voter behaviour. They do not want to take any chances. At the same time, they are banking on the theory that American Voters have the memory span of a goldfish.Take everything into consideration and my take is that we will get the correction in the 2nd quarter which will give Bernanke opportunity to start another QE.

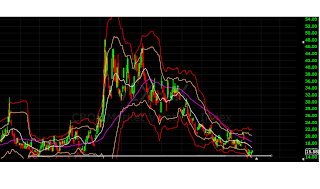

So we are going into 2nd quarter and already there are signs that the blow-off top is starting soon. May be from as soon as this coming Monday. I think SPX will top between 1450-1460 and by April OpEx will be the top in terms of time. But the majority of these gains will come in the next 4 trading days. Take a look at the following SPX chart.

There is a pattern from last December which I have circled. The index goes down for about 3 days and then shoots up making a new high. This is not TA. Just simple observation. Combine that with the cycle analysis and seasonality and odds are high that what I said above is going to happen. From now till April OpEx there are three weeks. If the market will listen to my plan, then the 1st week of April is when the market shoots up. 2nd week it retraces somewhat and goes back and forth. 3rd week it re-test the high and fails. The roll over comes thereafter. Let us see how it unfolds but I do not see many other alternatives. If you have a better plan please let me know.

That the people in the know are preparing for that final melt up can be judged from the action of the treasury market. Friday, TLT had one of the biggest one day drops in recent history.

However, those who think that end of the bond market is here, are probably jumping the gun little ahead of time. If we are going to see correction in equities, bond bubble will not burst now. Also Bernanke cannot afford to let the rates rise now unless he himself initiates it. The time for that is around November.

Apple most likely has had its share of correction for now.

I think it will also re-test the high in the coming week.

The US $ ETF UUP is breaking down the trend line and if we see the final surge in equities, that may well correspond will the down-move in UUP.

Remember the market always inflict the maximum pain on maximum number of people. In the coming weeks, people will be convinced that the bond bubble has burst, that US$ is going lower and SPX is going to 1550. They are going to be so disappointed. When the correction comes, dip-buyers will buy again, only to give up all the gains of these months. The bears will not venture forth initially because they have been burnt so badly. It is a game where the house always wins.

Thank you for reading my blog. I wish you all a very good week end. Please forward it to your friends and family and ask them to visit http://bbfinance.blogspot.ca/ and follow me on Twitter (@BBFinanceblog). You can post your comments in the blog or email me directly at bbfinanceblog@gmail.com. I look forward to hearing your thoughts.