It is said that there is never just one cockroach in the

house. The JPM $ 2 Bil. speculative loss reminds us of that. How many various

other kinds of loss are hidden in the cupboard of the Fed? JPM is supposed to

be the strongest of the rotten lot. What about BAC or C or other European

Banks? We know for sure that many of those are zombies walking around.

So what has changed after three years of the worst financial

meltdown in the recent history and trillions of dollars/euro liquidity pumped

in by the central bankers. Nothing really!

I know that a comparison of Bear Sterns with JPM may not be very

appropriate, but let’s just review the time line of the collapse of Bear Sterns

from an academic interest point of view: ( Source: Reuters)

1) December 14, 2006 -

Bear Stearns posts record earnings, touting huge profit gains from then-booming

businesses advising on mergers and arranging credit derivative, distressed debt

and leveraged finance deals.

Bear stock closes at

$159.96. The average price target from Wall Street research analysts covering

the stock, according to Reuters Estimates, is $166.24.

2) January 12, 2007 -

Bear shares close at a record $171.51 on momentum from its strong earnings report

the previous month. The average price target: $174.

3) May 24, 2007 - Bear

shares close at $147.55, a six-week low, after Goldman Sachs slashed its

quarterly earnings target for the rival investment bank, citing concern about

Bear's heavy exposure to the mortgage securitization business. The average

price target: $181.73.

4) June 14, 15 &

16, 2007 - On June 14, Bear reports earnings declined for the first time in

four quarters on weaker results from its mortgage securities business. On June

15, The Wall Street Journal reports a hedge fund run by Bear has suffered big losses

on soured subprime mortgage investments. (A second fund with similar troubles

would soon emerge.) The next day, the 16th, the Journal reports that Merrill

Lynch, a creditor to the fund, seized some of its assets. The stock closes at

$150.09 on Friday, June 15. The average target price: $181.

5) July 17, 2007 - As

losses from subprime mortgages begin to threaten credit markets around the

world, Bear Stearns informs investors in its two struggling hedge funds that

the funds have "very little value" remaining. Bear shares end the day

at $139.91. The average target price: $178.23.

6) August 5, 2007 -

Warren Spector resigns under pressure as co-president and co-chief operating

officer of Bear, having lost the confidence of long-time CEO James Cayne for

his handling of the subprime mortgage crisis. The stock closes at $113.81 on

Monday August 6. The average target price: $164.29.

7) October 5, 2007 -

Prosecutors launch a criminal probe into the collapse of the two Bear Stearns

hedge funds. The stock closes at $131.58. The average target price: $144.17.

8) December 20, 2007 -

Bear reports its first-ever quarterly loss, driven by $1.9 billion of bad debt

write-downs. It also says executives will not receive annual bonuses. Bear

shares close at $91.42. The average target price: $121.67.

9) January 8, 2008 -

James Cayne is replaced as CEO by investment banker Alan Schwartz. The stock

closes at $71.01. The average target price: $111.36.

10) March 12, 2008 -

Responding to market rumors of a cash crunch at the bank, Bear CEO Alan

Schwartz goes on CNBC television and assures viewers that the firm has ample

liquidity. The stock closes at $61.58. The average target price: $98.87.

11) March 14, 2008 -

JPMorgan, backed by the Federal Reserve, provides an undisclosed amount of

emergency financing to Bear Stearns. Bear says its liquidity position had

deteriorated dramatically in the previous 24 hours. The stock plunges to close

at $30.85. The average price target: $93.62.

12) March 16 & 17,

2008 - JPMorgan agrees on March 16 to buy Bear for $236 million, or $2 a share,

representing just over 1 percent of the firm's value at its record high close

just 14 months earlier. The deal essentially marks the end of Bear's 85-year

run as an independent securities firm. On Monday, March 17, Bear shares close

at $4.81 on optimism another buyer may emerge. The average target price: $2.

Yes, the same JPM.

Around that same time other cockroaches came out of the

closet. Lehman Brothers filed for bankruptcy protection on September 15,

2008. Merrill Lynch got purchased by BAC

on September 14, 2008. Then it took over 2 years to discover that too big to

fail banks are in fact living dead walking the earth and yet today they are

bigger than before. None other than a prominent Fed official is pounding his fist

on the table to break them up but it will have no impact whatsoever. So many

cockroaches got away in the height of 2008/9 crisis. They got fat with the

taxpayers money and now they are coming out again. How many months you think we

have now from sighting of the cockroach and final meltdown? I would say about eight

months to a year.

But that is a very long time horizon. Let us review what is

in front of us for the next week or two.

European Crisis:

By now everyone knows everything about how shi**y things are in Euroland. And

it is still a wonder that Euro has not collapsed yet. The reason being, the

same TBTF banks believe that their Chairman will bring in more free money here

in USA and ECB will start another LTRO in summer. Liquidity cannot save them forever

but may gain them some months. Now that Euro has closed below 1.30, the

immediate target is 1.285 after which there will be a short term bounce. I

think we will see 1.26 challenged by end of June 2012.

This will give Bernanke enough ammunition to start the next liquidity

pumping program.

Economic

Situation: Those who believe in the de-coupling theory and shout that

because US stock markets are going up, US economy is doing great, are in for a

shock. The fact is the world economy is sputtering and US economy is no exception.

The GDP count for the 1st quarter will come around 1.5, Europe is in

recession, Manufacturing index in India has nose dived, China, in spite of all

manufactured data, clearly showing signs of landing ( I suppose hard) and have

now reduced the bank reserve ratio. The real story of Chinese economy is told

by Australian Dollar which is going down and will soon be below parity. What does it all mean? It means that we will

soon see a concerted effort by all the Central Banks of the world to reflate.

Do not buy canned foods and that survival kit yet.

US Stock Markets: While SPX and DOW gave sell signal,

there is no sell signal from Nasdaq yet.

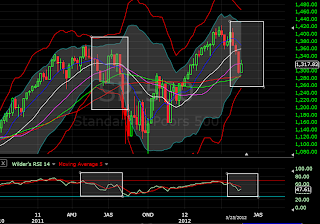

I keep repeating that we are following the script of 2011. An update of

RFG ( SPX Mid cap 400 ETF) is here.

You can match the points to the T.

In the coming week, we might see a lower push but by month

end we will re-test the Apple earning high of around 1400 again. I believe any

rally should be sold. You can follow daily

response to the market movement in our model portfolio. As of now, the model portfolio is short on

commodities, financials and Russell 2000. I would like to close all short

positions and re-enter later again.

Oil and Commodities:

I have said it before and will

say it again; crude and commodities will go down unless we see more easing. These

just reflect the world economy better than the algo driven bot controlled US

stock markets. I think Crude will bounce along with the general markets only

because it is much oversold. It is gets

past $ 93 in June, we would be looking for way down below.

Gold & Silver:

Just hanging by a thread. How

far it can go? Let’s see if this chart by Chris Kimble gives any indication.

I still think Gold will go upto $ 2500 in next 12 to 18 months

time but that will come in a different set of circumstances. For now, more

downside is to come. Again, there will be a short term bounce along with other

markets but I would stay away from going long gold for now.

It’s been a long post. So let me stop here by quoting

Charles Dickens: It was the best of

times, it was the worst of times, it was the age of wisdom, it was the age of

foolishness, it was the epoch of belief, it was the epoch of incredulity, it

was the season of Light, it was the season of Darkness, it was the spring of

hope, it was the winter of despair, we had everything before us, we had nothing

before us, we were all going direct to heaven, we were all going direct the

other way - in short, the period was so far like the present period, that some

of its noisiest authorities insisted on its being received, for good or for

evil, in the superlative degree of comparison only.

You see, nothing really changed even after 200 years.

Thanks for reading

http://bbfinance.blogspot.com/

. Hope you are enjoying my blabbering and forwarding it on to someone who you

think might benefit. I am looking forward to your comments and emails.