I know it is kind of boring to read the same thing. “Hold

on”, “don’t do anything”, “this market is not for investors” so on and so

forth. But what else can I say. If we got excited yesterday and jumped in, we

would have been very sad today. Even if there is bounce on the way, a better

entry is always welcome. So where in the grand scheme of things we are right

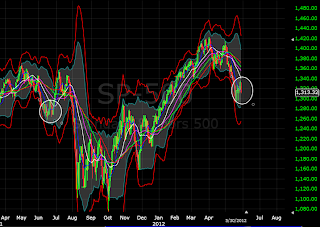

now? It is just my guess and please do your due diligence, but if we compare

the price action of last year, I think we are here:

The areas circled.

Here is an interesting tit bit from Bespoke

Ya, ya I know I know.

SPX is going to 1250 1st before any bounce or so they say. The funny

thing is when everyone and their grandma agree on same thing, opposite happens.

The sentiment is as bearish as it can get. We are almost getting to the point

where we are getting bored and develop fatigue about news from Europe. There is

no end of bad news from Europe and about Europe. But I tend to agree with

Nassim Taleb. Forget Europe, it is USA which is a bigger problem. http://www.bloomberg.com/news/2012-05-30/taleb-says-euro-breakup-not-a-big-deal-as-u-s-scariest.html

Remember my post about the giant Ponzi scheme few days back?

Coming back to the markets here at Ponzistan, we might see a

lower low intraday tomorrow but more likely than not, we will also see a

bounce. The FOMC is still three weeks

away and it does not serve much purpose to tank the market too much now. The

Chairman will not be able to take any action. Technically speaking, now is the

right time for a bounce. Can the market

go lower from here? Sure it can. 200 DMA of SPX is at 1283 and would be a good

support level. That is about 2% below from here. But the potential for upside

is more at this point. As and when the

equities go up, commodities will also go up, including gold. However, I would

still stay away from going long gold at this point of time.

I am not suggesting that you start buying tomorrow. All I am

saying is: maybe we should not jump on the short side now and just stay in cash

and see how things develop. I know,

again the same old suggestion. Boring.

Anyway, thanks for reading http://bbfinance.blogspot.com/ .

Please forward / re-tweet / post it on your wall and invite others to join.

(Twitter @ BBFinanceblog)(Stocktwits: Worldoffinance)

Thanks for all your efforts BB. Still holding long a few positions I haven't been stopped out of. Still hold a longer term bullish posture. Shorter term I'm waiting for the DOW theory ($TRANS) and NYSI to confirm a trend change. In the meantime swing trading GLD while keeping my eye on the DOW and Russell topping pattern targets.

ReplyDeleteSkidog

If we get a bounce in the next few days, I would get out of long positions. I think we will see weakness till end of June/ early July. But I am sure you have your risk controls in place and you know what you are doing.

DeleteMaking money is a boring a business, chasing short fuses only leads to blown up accounts.

ReplyDeleteYa :)

DeleteHi BB, shall we go short if one day SPX break 1280?

ReplyDeleteI do expect SPX to break 1280 but after a bounce. And I hope to ride along with it. But if it breaks tomorrow, then I am clueless.

DeleteAwesome blog!

ReplyDeleteThanks. Please circulate among your friends.

DeleteYou have said the first 2 days of June are still okay but not okay afterwards till the 3 rd week, is the trend still valid?

ReplyDeleteYes the trend is still valid. There is going to be an oversold and technical bounce but we need more time to bottom. Any rally is a sell.That is why I am waiting for the bounce to get over.

DeleteToo many shorts----all accumulating around 1282 to 1300.

ReplyDeletea severe short cover rally is due and every technical

computer set in advance is known by Bernanke and it looks

like he is waiting for the right moment-----bad job report

might do it.