Everything so far suggests that we will see a re-run of last

summer. Like last year, Europe is at the

front and centre of everything. Last summer QE2 was getting over. This summer

Operation Twist is at its end stage. What is new this year VS. last year is US

Presidential election. More the reason for free money. I keep looking at last

year’s price action and I get a feeling that the Algos are following the same

program with minor variations. Even in 2011, they were following the program of

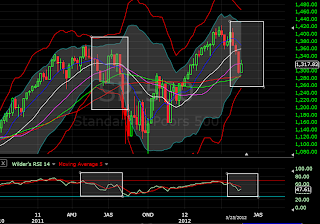

2010. In effect it is the same program for last 3 years. Take a look at the

weekly chart of SPX.

Why would it be any different this year?

The bounce so far has been weak. But that can change

quickly. All it needs for the Fed to open its swap lines to ECB. I would have

liked if NYMO was at lower level but it is already approaching zero. It is easier

to stage a bounce from oversold level.

The counter trend bounce therefore may not be very strong. Again, if we look at the daily chart of SPX,

the Fibonacci retrace levels indicate many different levels of bounce but the

one I am looking at is the 61.8% or 1368. That also happens to be the 40 DMA.

If it goes past that level, the next one is 50DMA of 1374.

Let us see how it plays out this week.

The settlement for last week’s huge treasury sale will be

this week. This may put some pressure on price action on Tuesday. But with no

major treasury sales due for the rest of the month, there is less need to

create panic and drive the rates down. That may be another factor whereby the

master manipulators let the treasury yield rise a little bit and allow the

stock market to go up with it. Already

the futures have opened higher but the markets are closed on Monday in USA so

it does not really matter what happens between now and tomorrow.

The Fed knows that it has painted itself in a corner but it

is reluctant to accept that. Everyone in the corridors of power knows what the

challenges facing USA are. There is a Seven Trillion Dollar asteroid ( yes, trillion with a capital T) coming in

the way of USA in 2013. That will knock off 4% of the GDP and will put USA in

recession. The first causality will be the Banks and they need all the free money that are

available. If you do not remember what

Bernanke said in last April regarding the looming danger, here it is to refresh

your memory:

"It's very important to say that, if no action

were to be taken by the fiscal authorities, the size of the fiscal cliff is

such that I think there is absolutely no chance that the Fed could or would

have any ability to offset, whatsoever, that effect on the economy," "I

am concerned that if all the tax increases and spending cuts that are

associated with current law would take place, absent congressional actions,

that would be a significant risk to the recovery."

In any event, the “recovery” that the Fed chairman talks

about is the recovery of the TBTF banks that he represents and not the recovery

of the main st. But that is the fact of

life and all your representatives are also the representatives of the big

businesses. So now the effort is on to find a solution to the coming disaster. http://www.reuters.com/article/2012/05/27/us-usa-congress-taxmageddon-idUSBRE84Q08320120527

Given all that why do you think SPX will go up at all,

let alone going to 1500 if there is no easy money from Bernanke? Just because

Obama wants to get re-elected does not mean anything to the real money bags! To

go there, we need fuel which is QE. If any opposing congressman wants to

protest against the Fed giving free money to the banks before election, the

best way to shut him is to give him a call from his broker or banker that the

world is coming to an end and his shares are now valued much less. (Except Ron Paul may be) Problem with the

giant Ponzi scheme that the Fed and congress are playing is like riding a tiger.

They cannot get down without getting killed.

We look at Fibonacci level, over sold or over bought or

some other crap to find out what the stock market will do next but the real answer

for the stock market going up or down can be found somewhere else. For the retail investors, who have lost money

every time s/he has tried to beat the system with various system, I can only say

that be very afraid. Preserve what you have and do not fall prey to the schemes

like the FB IPO or some other get rich quick scheme. This rally is to be sold into. Raise cash and

be patient. We have not seen anything

yet but remember timing is everything. The 1st rule of investing is “Preserve

Capital”. And be clear to yourself, are you investing or gambling.

Hope you are enjoying the “Memorial Day” long weekend. While

you are having fun, it will be nice if you remember that they have killed 1000s

of young men and women in the name of honour and glory in needless war which

did not protect American or made it any safer. We are not even thinking of many

thousand innocent civilians who got killed, maimed, ruined as incidental

casualties of war. And yet the real source of the problem, the states from

where it all emanates like Pakistan or Saudi Arabia, are our friends!

Thank you for reading http://bbfinance.blogspot.com/ .

Please forward / re-tweet / post it on your wall and invite others to join.

(Twitter @ BBFinanceblog)(Stocktwits: Worldoffinance)

What I don't understand is that if the market is a forecaster of the future, why is gold, copper, oil, not pricing in the QE. Also, China seems to be going down the tubes but everybody keeps talking about Greece. What can Bernanke do to stop a hard landing in China?

ReplyDeleteEquities have not yet priced QE. As I keep saying, this rally is going to be a counter trend rally and over sold bounce, only to resume selling soon.

DeleteAll risk assets will jump when Bernanke comes with the goodies.

Bernanke cannot do anything to stop hard landing in China. His magical powers are diminishing even in USA. People talk about what is in front of them. Greece will exit Euro, not now but in six months time. Will start contagion and the 2nd leg of the world wide depression.

In your opinion what is the end game? Does the US issue a new currency? If so, does that mean the FED blows itself up as part of the end game and Federal Reserve Notes are worthless? Also, does the US use this new currency to pay off or pay down UST debt or does US just throw in the towel on the UST debt? Lastly, once we get to the end game, will the EUR have already been destroyed? I know these are a lot of questions...

DeleteIt is difficult to predict how an end game will look like but one thing for sure, it is not going to be nice and pretty.

DeleteUS will never be able to pay its debt and no intention either. I think the interest rates will rise and US Dollar will lose its reserve currency status.

If there is a split in Euro, with a Norther Euro and a Southern Euro, people will prefer Norther Euro to US$.

Let us see how it all plays out but 2013 and 2014 is going to be very difficult structural adjustment periods.

helpful post - thanks for the clear thoughts.

Delete"Greece will exit Euro, not now but in six months time." - why in six months instead of in six weeks? the coming elections in 3 weeks would seem to provide a time scale for that event - just curious to hear your thoughts - thanks!

Simply because neither Greece nor Europe is ready yet to handle the subsequent problems. Greece is running an extortion racket and they are playing the game who blinks first.

DeleteOrdinary Greeks are much smarter than average Americans. They have lived a good life so far with money provided by others and when IMF boss says it openly that it is pay time, their pride and sentiment is hurt!

So they will continue to live in Euro and ask for more free money. It is not Greece who will leave Euro but Germany which will say enough is enough. Obama is begging and forcing Merkel to hold on till his re-election.

If I have read the tea leaf correctly, you will see pro-bailout parties forming coalition in next election and Greece getting some more money and time. By the way FOMC is also on June 19/20 and I expect new swap lines to ECB to be opened.

How do you think all of this is going to impact gold? It looks to me like a repeat of 2008 has already started in gold. Just like in 2008, gold should get thrown out with everything else, as those on margin will sell the good assets with the bad to raise cash. In 2008 gold corrected 35 percent from the high. If history is a guide, do you think the gold buy will be at the peak of the next panic?

DeleteI have a long term target of $ 2500 / oz for gold but I also think correction is not yet over.

DeleteAs usual excellent post.

ReplyDeleteThanks :)

DeleteBB

ReplyDeleteYou forgot to mention those poor souls who faced a choice between being burned slowly to death, or jumping from 80 or 90 floors above street level on Sept 11 2001. Furthermore, we saw the societies of "innocents" you choose to remember on our solemn memorial day ,cheering the deaths on 9/11. And finally, most of the people are on earth today would never have been born or been born in captivity were in not for the bravery and sacrifice of members of the US military. We solved Hussein and Bin Laden, so you can be free to sip your tea and write your blog in comfort.

No, I did not forget 9/11. That is why I mentioned Saudi Arabia. Possibly you forgot that most of the perpetrators of 9/11 came from Saudi Arabia and yet, Bush kissed the hand of Saudi King and Obama bend and curtsied.

DeleteYou are forgetting that it was USA that created Osama Bin Laden, another Saudi, and supplied him with money and weapon to fight the Soviets in Afghanistan.You forget that it was USA which made Saddam Hussein powerful by supplying arms and money to fight the Iranians in the 9 year long Iran Iraq War.

The Iraqi civilians had nothing to do with 9/11 just like the innocent Americans who were killed by the greed of their leaders.

You talk of bravery and sacrifice of US military and no doubt these brave men fought Hitlar. But you also forget Vietnam where they killed innocent people. You forget Abu Ghareb and countless other cases of atrocity of killing innocent people. Places where they had no business and yet these brave people were sent by the political leaders to die in foreign lands for wars which were not for America and the leaders themselves were draft-dodgers.

Selective amnesia or ignorance? Or may be your dear leaders have been able to brainwash you completely with half truths. But I don't blame you. I can understand that history has never been your strong point.

To the person writing about 9/11. "And finally, most of the people are on earth today would never have been born or been born in captivity were in not for the bravery and sacrifice of members of the US military." Give me a break with this quote. The enemy was positioned half way around the world in caves making up the Tora Bora region. Since WWII our military has been involved in idiotic police adventures. And this is coming from someone who voted for GW. The police adventures have done nothing but empower and enrich the Military Industrial Complex. Again I am for a strong military, but not one that is bloated and over stretched.

ReplyDeleteIts a clever myth created by the Neo-Cons and military industrial complex that if you question them, you are un- patriotic. Nothing is far from truth. While the heroic men and women in uniform deserve our respect, we should question why these people are being sent to die. For whom? So that Halliburton can get oil field contracts? If you are really patriotic and love your country, you should ask what purpose the lives of over 4000 solders served in Afghanistan.Because Bin Laden, whom the chickenhawk leaders created, was living with 3 wives in Pakistan making babies while solders were dying. And American is still giving over $ 1 Billion a year to Pakistan in aid so they can kill American solders? Go figure.

DeleteYour right about the neo-con myth, and another has to do with Federal Government providing Keynesian style deficit spending to fix an insolvency problem.

DeleteBB,

ReplyDeleteWith such a close cor-relation to last year, can you pleas share some thoughts on why Gold is not sharing the same patterns as last year?

Thx

What I have seen so far, Gold does well in inflationary environment and badly in deflationary situation.With yields reaching new lows, it is putting pressure on gold. But once the QE starts , gold will catch up. Its just matter of time.

DeleteGreat post, and great comments. I closed my long positions today. now we seat back and wait for other setups to come along.

ReplyDeleteWise move.

Delete