For over 200 years, America has been the place which draws the best and the brightest from all over the world. It is the place where dreams come true.

In his definition of the American Dream, James Truslow Adams said in 1931, "life should be better and richer and fuller for everyone, with opportunity for each according to ability or achievement" regardless of social class or circumstances of birth.

Let me quote from Wikipedia: “The idea of the American Dream is rooted in the United States Declaration of Independence which proclaims that "all men are created equal" and that they are "endowed by their Creator with certain inalienable Rights" including "Life, Liberty and the pursuit of Happiness." “

Such noble words! “Life, Liberty and Happiness”. Is there anything else in life? Yet, we now find that our dreams for a better life, a better future for the next generations are being increasingly threatened. The middle class, which forms the back bone of the American Society, is being squeezed like never before. Somewhere along the line, the dream has been robbed by the Grinch. The Grinch exists on both sides of the aisle. Today the top 0.01% of the population control over 70% of the wealth.

The last ten years have been exceptionally bad. We waged wars which were not needed, gave money to the super rich under political patronage, and even when the Oligarchy bought the country down to the ground with its financial frauds, we socialized the losses while privatizing the profits.

Three years after the financial tsunami, not a single person has been punished. Those responsible for the messes are bigger than before. They wrote a 2000 page law which promised much, but delivered little. One year after the Dodd-Frank Act, we still have no consumer protection as promised and only a handful watered down laws have been written so far which are totally ineffective. We put lipstick on the pig and made it beautiful. Grinch has really robbed our dream.

The giant Ponzi scheme that is being played on us is now reaching its end game. The illusion of prosperity cannot be carried on much more. The growth built up on borrowed money is collapsing like a house of cards. Look at the dark clouds on the horizon.

• The socialist economies of the Europe has almost but collapsed. The unemployment is Spain is almost 40%.

• Growth is negative in Italy, Greece, Ireland, Portugal, Spain, UK.

• Banks in Italy, Spain as well as France are dead men walking. With the slightest weakness in the global financial system, banks in these countries will be denied further liquidity, so necessary to keep them alive.

• Japan has been in depression for decades now with little sign of any life in the economy and with a debt to GDP ratio of over 200%.

• GDP growth is now officially 1.3% in the USA and 0.3% in Canada.

• Much closer to the shore, shipping container traffic is slowing, rather, decreasing alarmingly.

• The growth in China since 2008 is purely construction driven, with very little domestic consumption growth. This is another Ponzi scheme that is about to collapse soon, bringing the commodity sector down with it.

• The ports in China, the export powerhouse of the world, are seeing their total numbers falling dramatically.

• There is no job growth in the USA nor there any real income growth for the last decade. The consumer spending which constitute 70% of the economy is unsustainable when the QE is taken out of the system.

• The major shock is going to come from the Balance Sheet Contraction at a global level. Here in the USA, just the residential housing sector has lost well over $ seven trillion value from its peak. Add to that useless MBS that the financial institutions hold, trillions of dollars of derivatives based on such valueless properties, and we just sitting on a ticking time bomb.

• The frauds in the financial sector continue and more than ever, Government is now a part of that fraud, aimed to keep the status-quo going.

• Since 2008, over $ two trillion has been pumped in the system, to give the wealth effect based on the misguided trickle-down theory. All it has done is to increase the debt to more dangerous level, where the law of diminishing return is now in play. It has merely helped keep the big banks alive yet reducing the market value of assets in their books. If the banks follow the proper accounting principles, and start marking their assets to the market, instead of fantasy, each one of them will be bankrupt. Yet, today they are pillars of our financial system.

• We have not touched the Geo-political tensions that are smoldering in different parts of the world. Bombing of Iran by Israel is a real possibility. The unrest in MENA region is going on and Syria is about to explode soon. China is having serious tension with its neighbor in the south sea region. In South East Asia, Pakistan is an unstable country with nuclear capability and the fountain head of global terrorism. Pakistan with its proxy Muslim fundamentalist military dictatorship is hell bent on destroying secular democratic India. India and China are having issues with water. Drinking water is going to be a major flash point and potential conflict point in the future.

These list can go on and on. But there is no way the western civilization can continue to enjoy the lifestyle of the last 40 years. The payback time is here and now.

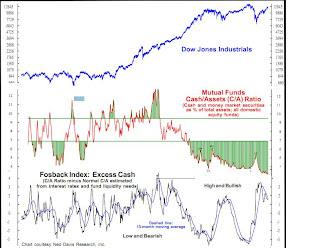

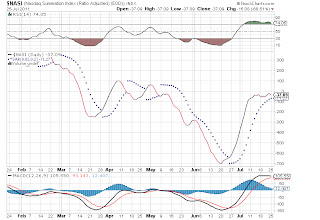

The debt drama is just a diversion from the real challenges. I never doubted for a second that America will raise its debt ceiling. Each politician owes his/her position to some special interest groups. Do you ever think GS or JPM would allow the USA to default now? After-all even the most power-full politician in Washington has just one head on shoulder. This drama was just to scare the general population to sell cheap. The next chapter will be euphoria. The Boyzs who control the markets, know that the end is near. They now need to make one last effort to suck as much money out of the ordinary Americans and their retirement funds and savings.

It is a monkey business alright. If SPX can fall 50 points in three days, it can also go up 100 points in six days. Do not be surprised to see the markets making new highs in August. But that will not be the beginning of a new bull market. Rather, it will be the beginning of the end. Hope you have not sold out in this panic. Sell when the market is experiencing an out of the body high and be prepared for the next storm. It is coming.

Follow me on Twitter ( bbfinanceblog ) to get the up dated real life info which cuts through the smoke and mirror and forward it to your friends. http://bbfinance.blogspot.com/