As far as drama goes, it cannot be any better. Nail biting, thrilling, turn at every hour. You name it we have it. Dems are blaming the Reps and vice versa. Who is to blame on this debt drama? Who bought Americans to the sacrificing alter? Look at the following chart.

You have the debts as a percentage of GDP by the Presidents of both colours. You decide which party is to be blamed more. I am in neither party. However, it seems to me that when Bush II got to drive the car, the ratio was below 60% and when he handed it over, it was well over 80%. Hmmm. Interesting to say the least.

Who is winning the debt debate? After all, this is all about the next year election and winning the hearts and minds of the voters. Again, I do not carry any favour from any party and I am sure things will remain the same whichever party wins next Presidency. But from what I read and hear, I do not think Reps have conquered too many hearts of the independents. As everyone knows, independents are the key to the White-house.

The current president was elected on Democratic Party ticket, but he has turned out to be George Bush II. All his policies have been directed at maintaining the status quo and giving more freebies to the super rich and big business as well as to Wall St. To his credit, he is a great reader from teleprompter and says the right words for the poor people.

But I know who are not winning. The average Americans are not winning. And Chinese must be worried sick that all their hard-earned money may soon be worthless. I wrote few days back that American can never repay its debt and it is a sucker’s game. I never expected that it will be proved right so soon.

In any event, the economy is going down and what will trigger a black swan event is not known. I feel that Spain and Italy will implode soon and that will trigger the dominoes to fall.

I still think, they will get past this debt debate in the last possible minute. Some readers have asked why I am not more bearish at such uncertain time. Reason being, there is not much uncertainty about the outcome. Chances are 99% that the limit will be raised. The credit rating is another matter altogether. The uncertainty is about time.

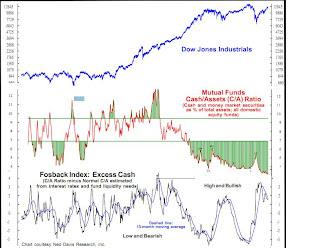

I think we are still in a Bull market, although it is coming to an end. The following picture explains the bull market.

If you see the DOW, it has so far made higher lows and higher highs and is well above the 200 DMA.

I have underlined the lows in the chart. I expect it to make one last high before the turn. The resolution of debt ceiling drama may be the trigger for that. So I was not ready to go short at this point. The market is fuelled by, amongst other things, liquidity. And there are enough liquidity in the market right now. See the Mutual Fund Cash/Asset ratio.

It is still bullish.

From 2010, we have heard so many times that the sky is falling. Double dip panic, Greek panic, Japan Earthquake panic, China panic, Muni panic. At each state, they have scared us to sell cheap only to buy back at higher level. They would shout boo and we would jump. But the point is, from Feb.2011 we are moving in 5% band and we have not broken that band in any direction yet.

Today, the McClellan Oscillator is deeply oversold.

VIX has crossed BB twice in a row.

Yesterday VIX jumped 35% over it’s previous close. As far as panics go that was huge.

The market may go down one more day before finally bouncing back hard. Tomorrow the QE2 GDP will come out and it may miss expectations. Coupled with uncertainty, this may trigger the SPX to dip below 1300 level. But as soon as we have a resolution of this drama, we should have a huge relief rally. There is a 1% chance that things get blown away by the collective death wish and then we have that black swan event now. But the odds for that is less.

God bless America.

I'm glad to see you keep track of the 'Fosback Index', or as some would call it, the adjusted Mutual Fund Cash ratio.

ReplyDeleteFosback himself considered this to be his most reliable indicator of intermediate trend. He mentioned that many times in his 1990s Newsletter (MFF), to which I subscribed.