Today was an example as to why everything has to line up together before we can take a trade. That way we can reduce the risk. The important word here is REDUCE. We can never eliminate risk is trading and there is no system in world which can guarantee you risk free trading. Let us start with a closer look at SPX 15 minutes.

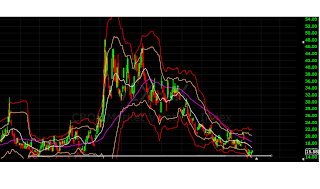

The chart may look complex but actually there are two BB. The outside one in red colour is in 3 standard deviation. The one next to it is BB with 2 standard deviation which is our regular BB. Then we have two moving averages, fast and slow.

The continuous push higher has stretched the prices beyond the rule of physics. If history is any guide, whenever price has moved away over 5% from the 50 DMA, it has reversed to the mean quickly thereafter. The red BB which is 3 SD from mean acts as the outer limit. When price push that limit, either up or down, price will correct shortly thereafter.

You can see that SPX has been pushing the outer limit (red BB) and is now time to revert to mean. Mean today stands at 1344. Will we see that correction? If and when it comes, will it mean that the up-trend is over? Possibly yes and no. However, if the correction has to come, it has to be fast and furious. There has to be a 70-90 point correction in three days or so. A gentle correction will not do. That was the reason I did not take the short trade today although the hourly reversal was triggered at 1405.

Let us take a look at VIX.

It seems VIX has formed a bottom of sorts as of now. Can it go down further? Of course it can and it will. But not yet. In case of VIX, price has touched the lower outer limit (lower red BB) and here also it will revert to mean.

As I wrote yesterday, US $ index have staged a reversal after 3 days. I expect it to test earlier high of 81.50 in the next 7/ 10 days.

The difference in price action today was the way it covered the morning dip. From my perspective, today the rebound in the afternoon was not strong. Earlier, the dip buyers would cover any morning dip and some more. Today was one of those rare days when everything ended in red. Therefore I feel a kind of tiredness and exhaustion. Also, the Demark sell set up is supposed to trigger tomorrow.

I think the market may be up tomorrow, at least in the morning when they will squeeze the fresh bears and then we might see long anticipated sell starting Thursday.

However at this point this is just a speculation and the trend is still up. The point of highlighting this possible correction is not to short in advance but to stay away from new long set ups and have a very tight stop.

Thank you for reading http://bbfinance.blogspot.ca/ . Please forward it to your friends and join me in Twitter for live market commentary. (@BBFinanceblog).

BB, do you sometimes trade TVIX? I followed it the last few weeks and it doesn't look to be strictly inversely related to the VIX. I don't really trust/understand that vehicle and probably will stay away of it for that reason - although at times like this it is tempting to go long....

ReplyDeleteIt is inverse of VIX futures. Sort of derivative or derivatives and too complex to trade. There are so many other easier ETFs.

DeleteI took partial profits but then shorted more TF, QQQ and FAZ. Will short more if it goes up. Will go long PMs (NUGT) soon.

ReplyDeleteGLT Win

Delete