Like clockwork, we had a red day today. Nothing serious, at

least not yet. It just let out some excess steam before reaching the April 10

high. We are about 25 points away from that and I expect the retest will happen

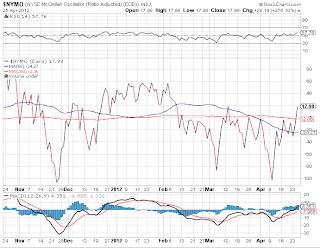

by May 2, Wednesday. While the momentum

is definitely weak, there is no sign of definite sell signal yet. But it looks

so similar like last year which I have marked in a rectangle.

If this pattern is to play out we might see an overshoot of

the last high. It may not be a bad idea to start laying the defensive bets

now onward.

When the correction comes, it will be fast and furious and

will not give us much time to take advantage. But at the same time, it is risky

to front run, as I keep saying. So we will have to pick up sectors where there

are definite weaknesses.

Copper is having a bounce but given that the demands in

China are slowing; it might be a safe play to short copper. Oil is another one,

because oil sells off every summer. Emerging markets are struggling. Financials do not look particularly strong nor do Russell 2000. We will see what day after tomorrow brings. It does not have

to be all in at one go.

For tomorrow at least, I expect the market to be up if not

substantially. If on the other hand, we

do not end strong green tomorrow, it will confirm that the end is close. I

would like to end today’s post with a quote from the famed investor, historian

and economist Peter Bernstein. ( Hat tip to Joshua Brown of reformed Broker) :

“I have opted for

more conservative ideas and not aggressive ones.”

"After 28 years

at this post, and 22 years before this in money management, I can sum up

whatever wisdom I have accumulated this way: The trick is not to be the hottest

stock-picker, the winning forecaster, or the developer of the neatest model;

such victories are transient. The trick is to survive. Performing that trick

requires a strong stomach for being wrong, because we are all going to be wrong

more often than we expect. The future is not ours to know. But it helps to know

that being wrong is inevitable and normal, not some terrible tragedy, not some

awful failing in reasoning, not even bad luck in most instances. Being wrong

comes with the franchise of an activity whose outcome depends on an unknown

future (maybe the real trick is persuading clients of that inexorable truth).

Look around at the long-term survivors at this business and think of the much

larger number of colorful characters who were once in the headlines, but who

have since disappeared from the scene."

I am reading the above post again and again and would

request you to do as well.