Everywhere you look today there is a mention of how Chinese

data is fake. Yawnnn! Have they discovered God in the laboratory? Of course

almost everything that comes out of any Government is false. China may be

faking 90% of what is reported but look closer at home. I think almost

everything that USA reports are blatantly false. Be it BLS job data, GDP data,

Housing data, Loan data or even serious things like WMD. Colin Powel even lied

before the UN and US went to a false war on false pretext. So I fail to

understand what the big deal about the false data out of China. Whoever

believed it in the 1st place please raise your hand. You must believe

in tooth fairy as well!

Europe has been the front and centre of our life for the

last few months. But so it had been in these very months of 2010 and 2011.

Every June, from 2010, we feel that Europe is coming to an end. The fact is,

America will falter before Europe. If Europe is struggling because of its

massive debt, if Japan is in depression because of its 200% + Debt:GDP ratio,

just wait when the chickens come home to roost in USA. With its $100 Trillion

unfunded liability, many more trillions of dollars of Muni Bonds, almost 100% official

debt to GDP ratio, destruction is staring at the face of USA. Many of my

American friends think that USA is the best house in the bad neighbourhood.

Actually, it is the best camouflaged booby-trap in a jungle.

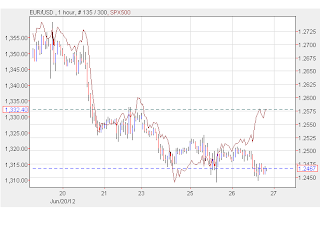

In a ZIRP environment, the only solution left to the Fed and

politicians is to print more money. Already the money supply is running at 9%

and yet we see deflation all around. The 10 year yield at the height of the

economic crisis in 2008 was 2.10 % and now it is 1.67 %. So the bond market

thinks that we are closer to a disaster now than we were at 2008. Every

successive QE has demonstrated the law of diminishing return and just to get

back to 1400 level of SPX, Bernanke will have to pump another trillion dollar. Even

if he does that, nothing will change. And yet he will do it because his

political master wants him to do so. The long term 30 year cycle of bond yield

has topped now and in a matter of weeks and months, we will see yields

rising. Time to scale in TBT.

The short term target remains as we discussed and nothing

has changed. We might see a lower low on Monday before we shoot up one more

time. If I think there is a trade worth taking, I will send the information through

Twitter. The real damage will come after that which will force the hands of

Bernanke. Barring one day, June 4th, there has been no panic in the

market so far and just for this reason, I think selling is not over.

Those of you who swear by TA I have a nice article for you

from Brian Shannon. Brian wrote a book on Technical Analysis:

The market is tricky,

and it seems so even more lately. Technical analysis is often misinterpreted as

an exact science, it is merely a tool which allows us to determine potential

price based scenarios before we commit our money to a position.

Lately we have seen a

lot of technical analysis misused. From a couple of closes below the 200 day

moving average being interpreted as bearish, to a couple closes above the 50

day moving average being interpreted as bullish, or believing that one can buy

the break above the “neckline” if the inverted head and shoulder pattern and

then kick back and wait for the price objective to be met. These examples of

‘failed technical analysis’ are “proof” by doubters that technical analysis is

useless. If you are going to succeed in the markets, risk management

should be your first priority, regardless of what your timeframe is. I consider

technical analysis to be the finest risk management tool that anyone can use if

they really understand the psychology of the formation of patterns rather than

focusing on pattern recognition alone.

Also from Tuesday’s

post — As I often point out, moving averages should not be used as a stand

alone tool, but they give us a great reference point to compare price to. We want

to objectively observe how price acts around those levels on shorter term

timeframes The same goes for trendlines, price patterns, oscillators,

Fibonacci, etc We want to be aware of these key levels which motivate others to

take action so we can ANTICIPATE the likely scenarios, but wait for price

confirmation before we PARTICIPATE and put our money at risk.

Price is objective, we

often we are not.

So let us be objective and be aware of the bigger picture.

Time is running out.

Hope you are having fun in this beautiful weekend. Stay

sharp and filter the noise. Thanks for reading

http://bbfinance.blogspot.com/ .

Please forward / re-tweet / post it on your wall and join me in twitter.

(Twitter @ BBFinanceblog)(Stocktwits: Worldoffinance)