We do not normally value what we get free. But I think my free advice “Do not short” has more value than many paid subscription services. At least I was able to save some from harm’s way and protect capital.

It now looks more likely that we will re-test the high of April 2. It may not happen tomorrow but we have few more days to go there. We will evaluate the momentum and strength of the test in the next few days and decide whether to short, depending on whether such a retest fails or makes new high. I do not think it will make a new high now.

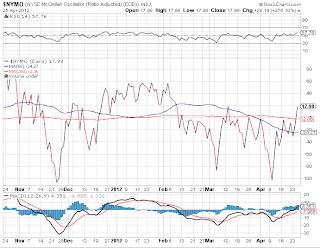

The Pavlovian dogs started salivating the moment Bernanke mentioned that he is ready for more accommodation. What he did not say when he will start new QE. But with the super duper result of Apple and hint of more free money, the market has sprinted out of the gate. I think it can go up for few more days. NYMO has now crossed in positive territory and not yet overbought.

The market is keeping both sides interested and in the process killing both the bulls and bears. It is amazing to see how quickly the sentiment changes. Now we will have new believers who think that the correction is over and will bring in their money to get long. Beginning of a new month is around the corner and those who were lucky enough to sell around the top, will now think of going long again. Those who missed the boat last time, will jump in early, only to be fooled by the market again.

But if we stop to think, nothing really has changed from last week or the week before or even the months before. We are muddling through till we cannot. Only thing that is keeping the circus going is the unlimited CB liquidity. Some of you may not agree but that is a fact. Also the fact is, it is an election year and we are coming close to a long term cycle and this script has already been played before.

Do you remember this chart I had shown before?

This is SPX translated in Euro, matched against Nikkei. The picture gives the general direction and do not indicate absolute levels of highs or lows. Everything that I follow tells me that this is the path we will take. So expect a new high this year before they tell the last man out to switch off the light.

That’s all the free advice for today. Thank you for reading http://bbfinance.blogspot.ca/ . Please forward it to your friends and invite them to join me in twitter. (@BBFinanceblog).

I really apreciate your insights.

ReplyDeleteThat is the music...one should decide if it dances or not...

BBF,

ReplyDelete4/25 afternoon, $SPX on 15min, price candlesticks are moving upward versus RSI and MACD diverging downward. Similar to afternoon highs on 4/12 and drop on 4/13. The inverse happened on the afternoon low on 4/10 and price jump up on 4/11.

Have to see what happens tomorrow.

GRC

Hi GRC,

DeleteAfter a huge gain of yesterday, there may not be much follow up on the upside today. The momentum is slowing and as I have been writing, we should sell in these rallies. No need to go long, no need to short. Just get out and be on the sideline.

The drop today may not be very big as US$ is weak today.

What do you think of the sudden drop in GLD today (Apr 25)? Thanks!

ReplyDeleteGold is reaching the bottom of the cycle. Yesterday's drop was possibly a knee jerk reaction to Bernanke's talk. But it has gone up since then.

Delete