If you want to understand today’s market action, just look at the following chart.

It is the movement of AUD VS SPX. SPX basically moved tick for tick with AUD.

For the 3rd day in a row, rumors pushed the market higher from its depth. Today’s rumor came not from FT but from Nikkei.

Which of course is not true (how otherwise it is a rumor) and AUD is giving back its ill gotten gains.

SPX once again tried 1265 area and was rejected. Today’s low shows that the top was in fact reached yesterday and tomorrow we shall see a re-test of the lows. What rumor are they planning for tomorrow? I think this situation will continue till Friday, December 9, when another team Merkozy dog and pony show will come out big on words, small on actions.

Although I called for a top yesterday, I was surprised to see the speed and depth of the fall in the morning. Because at the same time, I have been telling readers that this is a very short term trading and I do not expect much to the downside. However when I looked at the price movement of gold, I noticed the huge divergence between the price action of gold and SPX. Ideally all risk assets should move in tandem. But look at the price movement of gold between 9 AM and 10 AM. Gold was in a range where as SPX was going down. Again between 1PM to 4 PM. Ultimately SPX did catch up.

The reason I am looking at all risk assets (AUD, Gold, SPX) is because the HFTs and Algo Bots are programmed with that correlation in mind. So any divergence should be viewed with suspicion.

In any event, someone is trying hard to keep the market up. If they let the market correct now, we can expect a bigger push in the year end. Otherwise Santa will be unhappy with the naughty children in Wall Street and will not give any Christmas bonus.

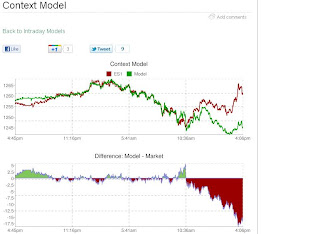

I borrowed this chart from Capital Context to show the divergence between various risk assets.

Also look at the Context model. I can bet that the market will catch up with the model sooner rather than later.

I will be shorting gold by this week end, if I see Gold holding or crossing $ 1750 level. The major correction is expected between Monday, December 12 and Wednesday, December 14 for all the risk assets class.

Do not fall prey to the rumor mongers. Rather consider this as an opportunity to profit. The MOMO chasing lemmings will surely die.

Thanks everyone for joining and following me on Twitter. ( @BBFinanceblog).

Indeed, it is best to gather information for yourself from various reliable resources and making a wise decision after scrutinising all the data in front of you. Just like getting a Down Under travel insurance for example. A choice based on rumours and impulse can have life-changing consequences for a traveller.

ReplyDelete