Yesterday while the US$ index made a new high, equities and gold ended in green. And people have started believing that this time will be different. I hate to be the bearer of bad news. Sorry, no Virginia, there is no decoupling of USD and Equity. Not yet. Every time dollar has risen without having an influence in the ES, the SPX rebalances in the next season. This was one of the reasons I went short last evening before close. Even today US Dollar index climbed higher.

It climbed above the 50% retracement level and I think it will rally a few percent higher in the coming days. The following chart is from Chris Kimble.

FX is just one of the many parameters I use but it is powerful and easy to explain. So that is why you see me comparing AUD with SPX over and over again. It is just a confirmation tool for me. I do not trade based on AUD, I just use it to re-confirm my thoughts. So far it has proved to be correct. When the interest rates in USA will rise, the whole AUD carry trade will be discarded and then this correlation will no longer work. Till then it is a useful tool in my toolbox.

My predictive tools are telling me there is not much room to run on the upside. But I am not sure that we will see a deep correction. It is called January effect and it is also a Presidential Election year. The most powerful man in the universe is fighting for re-election and you don’t expect him to roll over without a fight. He knows that his chance of re-election depends on keeping the share prices high and money flowing in the hands of the oligarchs and TBTF banks. Now you need to figure out how 2012 is going to be. But historically, January has been the best month for stock gain, with some weakness in the middle of the month.

So far in the year, stock market has behaved the way it is supposed to behave. Not-withstanding the barking of the rabid dogs of doom and gloom and incessant chatter of nonsensical unicorns and gold pot at the end of the rainbow on 24 hour news channels, there is no surprise. Volatility, yes. Surprise, no.

I have added to my short position of yesterday and it is going to be a quick play. I will tweet / post to my readers when I am getting out. If truth be told, my heart is not much into shorting this cycle because I am not finding a strong down trend. I am short partially because my cycle analysis and other parameters are telling me that the markets have reached the top and will have to correct before the next push up.

Today was the Non Farm Payroll day. You can call it a pivot day. Although the data that comes out is BS and is a work of fiction, it carries incredible weight and influences the market behavior. The normal trend is that on NFP day, the market either open high and go lower or open low and go higher. Today it opened high but closed lower. I would think that a NFP day is a turning point more so when it is a down day. That fits well with the seasonality and cycle.

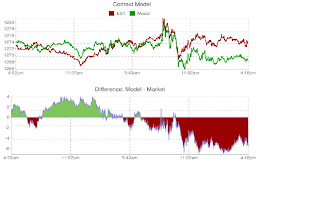

The market actually tanked today but was manipulated back to minimize the damages. If you look at the Context model which basically tracks the ES, you can see that ES diverged at 11 AM Eastern. The market normally catches up with the model so we can expect more downside on Monday.

I want to show you the following chart which compares divergences between NYMO and SPX. Hat tip to Mr. BachNut. It is his chart and is a great one.

The chart fits with my overall market analysis. There are some highly intelligent and analytical traders out there. I would request readers to send their comments, suggestions & charts so that collectively we all can become better traders.

Gold is struggling to hold $1620 level and Oil has started giving up the gains but I am not inclined to short them. Gold cycle is reaching a short term bottom and we might see a huge up swing by end of January. And Oil is a highly manipulated market controlled by few big players. So I normally avoid dabbling in it.

So that’s it for the week. We survived the 1st week of 2012.Weather is balmy 10 deg C. So let us forget the stock market for a while and have some life with friends and family and loved ones. The new design of the blog has lots of buttons. You can follow by email or click on “follow me on twitter” button to remain updated. The cool thing is the “Share it” button. I would sincerely request you to share it with your circle. Post it in Facebook or retweet. Tell your friends about http://bbfinance.blogspot.com/ . Thank you all for sharing my thoughts. Have a nice weekend.

Thank you for the excellent analysis. Good weekend to all.

ReplyDeleteThanks.

ReplyDeletePicked up some TZA shares at 24.90 and then again in the afternoon at 25.00

ReplyDeleteGot a nice boat full. Thanks for the posts.

I come here for a little extra clarity in my decisions.

have a great weekend

-Mike

Howdy BB, my handle is TexEx over at Slope. I usually only lurk over there. This was a terrific post, and thank you for it. I plan to visit your blog often. If you do not mind, where can I find more information about the Context model? Thanks again.

ReplyDeleteTHANKS for all your work. I love this site - NO BS

ReplyDeleteI check it everyday!

Mac

that can be said to be Inverse HnS in the dollar chart ..a huge one ..

ReplyDeleteThanks, TexEx, Mac, Jonak.

ReplyDeleteYou can visit Capital Context and some of the charts are available free for public. http://capitalcontext.com/ Again, use this as only a checking tool and not a main one. They have their own bias and preferences like everyone else and they want to sell you subscription.

From TexEx, Thank you kindly Mr. Finance.

ReplyDelete