The day was according to the plan. All the asset classes are

moving in tandem and appear to be in line with the expectation. A quick review

of various assets classes are as follows:

Equities: We are

coming closer to the cycle top and while my upside target in SPX is 1425, we

came pretty close intra-day at 1420. Will that be considered as target met? I

have started scaling in short positions with inverse ETFs for indices and will

add some more tomorrow. Again, the basic premise here is “Patience” and “Agility”.

The correction may or may not start tomorrow. But this was a counter trend

bounce which we called well in advance and had a bounce target. Now that we are

close to that target, both in terms of price and time, it seems that short

trades are high probability trade. The

coming down move most likely will make a lower low than what we had on November

16, enough to create doubt and fear in the minds of the retail investors. That

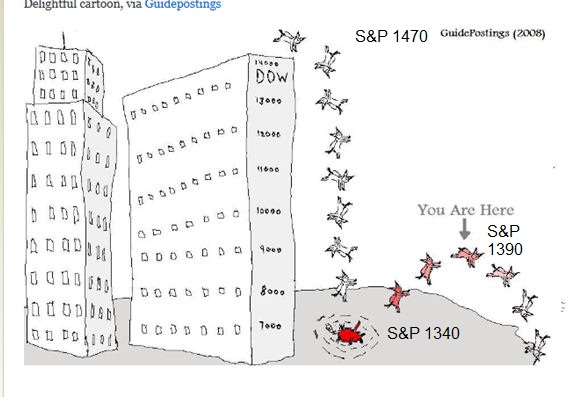

is when the Boyz will buy cheap and pump the prices up again. As you have seen in yesterdays Dilbert

cartoon, someone will create Media frenzy, Banksters will pump or dump the

prices and Sheeples will be sheared off.

I am sure that when I will call you guys to go long next

month, many of you will hesitate and wait for everything to be OK. And when

everything will seem OK, it will be time to sell again. To win this con game,

we have to go where the puck is going to be, not where the puck is.

Precious Metals: Silver

had a moment of madness and spiked higher but gold was not able to cover the

loss of yesterday. I did take a small short position in silver with ZSL with a

very tight stop. If Silver closes above $ 35 next week, I will close this trade

but for now I expect silver to correct along with equities. How much it will go

down I am not sure. The 1st target is a close below $33 and then I

will add some more short positions. So right now, there is a range for this

trade and I would be monitoring this range for further action. I am not

touching gold for now and will wait for all risk assets to bottom before going

long again.

Crude: Crude made a possible double top around $

88.50 and did not held on to the gain. Like equities, here also the short term

cycle has topped or about to top and I do expect further correction in Crude

prices. I am short crude with SCO and will add some more tomorrow. Once it

closes below $ 86, we can be very sure of the coming correction and the minimum

downside price target would be around $75-$77. Let’s wait and see how it plays

out. I think this one is a high probability trade.

Coffee: While coffee seems to have made a bottom, the

hourly chart is overbought and we might see some pull back shortly. It is where

that pullback ends will give credence to the bottoming of coffee. There is no

hurry. From a high of $308.9, coffee had corrected to $ 144 which is more than

50%. So we have lots to cover on the upside and we can afford to wait for a

while for confirmation. I just want to draw your attention to this potential

winner.

Nat. Gas: Most

likely it gave a short term sell signal but I do not think it is going to be

anything serious. The biggest oil company in the world, Exxon Mobil is getting

in Nat. Gas in a big way and when such a giant starts taking a position, we

know the future. I would be looking to add Nat. Gas as a long term play in

future.

Bonds: For many

months now Bonds are moving in a range. TLT made a high in last July and since

then it is just chopping around. As there is no clear direction, I have not

touched it. But the long term trend is clear. If you are long bond, it would be

better to book profit. The interest rates will start going up starting sometime

in the next 3-4 months. TBT will be the

trade of the life time then. But we will have to wait for that trade as the

time is not yet ripe for taking any position in Bond. The inverse relationship

between Bond and Equity is about to get discarded.

That’s all for tonight. Thank you for sharing my thoughts.

Hope you are able to pass on the blog to your friends and join me in twitter

(@BBFinanceblog). As I said yesterday, come January, we will have a paid

subscription service to selected few with specific trade ideas. I will be

emailing at least once a week high probability trades with entry, stop loss and

exit points. If you have been reading this blog for a while, you know that I

will try to minimize risk and look for high probability trades. Of course it will be a paid service and I am

looking only a selected few. So if you are a serious investor, with investment

of minimum $100 K or more, looking to earn decent return on your portfolio

consistently without speculation or undue risk, do send an email to: bbfinanceblog@gmail.com to be

included in the mailing list.