So here we go again. SPX up 4 days in a row and yet except

one day, it has not done much. In 4 days it has covered less than 50 points and

is struggling with the Fib.38.2 retracement level. There is only half a trading

day this week and then the cycle is up for another 4 /5 days. As of now, I do not

think SPX will cross 1410 with any conviction and even if it does, most likely it

is going to falter at 1420.

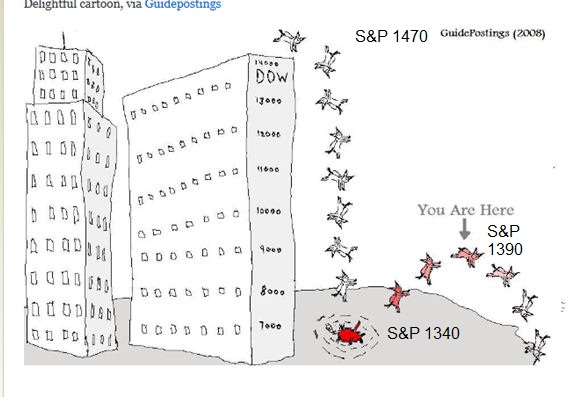

I borrowed the following picture from Peter Brandt.

However I disagree little bit with the level of the bounce

and I think it will bounce another 15 points higher from here although I bailed

out.

I closed my TQQQ call options today and half of the long

position in Nat.Gas. Although there is no immediate danger for Nat.Gas and

prices will most likely go up some more, I decided to take some chips off the

table. We must leave something for the next guy.

The Middle East cease fire was inked today after few last

minute blasts but Crude was up for the day, although it was at the same level

as day before, just below $ 88. If you listen to the logical explanations of

the Crazies, you would expect Crude to sell off after the fighting stop. But

the opposite happened. Yesterday I wrote that it is still little early to short

Crude. We need to wait for few more days till the bounce fades in all risk

assets. This is another trade which I think would be a safer bet.

Another short trade I am looking at is Silver. If Silver

fails to clear $34 by the next week end and closes below $32, I am going to

take a stab at shorting silver. But for that few conditions have to be met. I

will tweet if I enter the trade.

Also, take a look at coffee, which I think is making a long

term bottom like Nat.Gas. Out of the two vehicles for coffee, JO and CAFÉ, I

prefer JO. It is less volatile and more stable.

30%-40% return is quite possible in a year but you have to give it time

and be patient.

You see, there are lots of opportunities and fish out there

without worrying too much about the equities. We will either go long or short

when we have all the parameters lined up. But in between there are other

opportunities which we can be watchful for.

That’s all for this evening. If you are travelling, travel

safe. Don’t let the trolls at Airport bother you too much. And for your Black Friday shopping, do

remember the Amazon link in the blog. Once again, thanks for the donations.

Thanks for your great work. I see eye to eye with you for the read on the market. I would add that investors/speculators should really look at trading commodities in addition to equities.

ReplyDeleteAs far as your thinking about the coffee trade, I think it could be a good one. Large speculators are really short here,but I would want to wait for confirmation first, i.e. for JO players like myself, a close above $35.60 with a stop just below 33.40(my system) for a scaled in trade. The reason for caution is that on the P&F chart we have a double bottom break on the daily. If you look at the 60min P&F, you can see that this would confirm it. I don't want to catch a falling knife but I like scaling in early for minimal losses.

Thanks for pointing this one out to us.

You are 100% correct. We have to wait for confirmation and scale in slowly over a period of time and with proper stop loss. Never jump in any trade blindly.

DeleteThanks for pointing it out. Please do share your inputs here.

Have a great ThanksGiving.

Great blog, I have enjoyed reading your timely insights. You use cycles in your analysis which is great. I have yet to find a good source for cycle analysis. Can you lead me in the right direction?

ReplyDeletecycle analysis is the basis for which I have my own Algo and I keep learning and tweaking it as I go along. The results now are much better than they were two years back. I am not sure where exactly to guide you but Tom McClellan runs a news letter which uses cycles.

DeleteYou can get in touch with Tom. He is a perfect gentleman.

I can say that the title is very catchy.. and i totally agree with the idea

ReplyDelete