Nothing much to say really. Today was a nothing happened kind of day. In the morning when the futures were down about 5 points, I sent out tweets that it is not the real deal. We may still have to wait for few more days to see some action.

I have initiated some short position yesterday and they are almost unmoved or in small red. So that's not all that bad. I cannot expect to hit the nail on head in every attempt but at-least it did not go up huge. There will be couple of false moves before the real one. Have to have patience.

Bulls and bears have their own story to tell and both sides have merits in their argument. But I am following cycles, which says that possible trouble ahead. All the price levels that were to be achieved, have been reached for now. And a cycle top is close by. So let us see which way the wind blows.

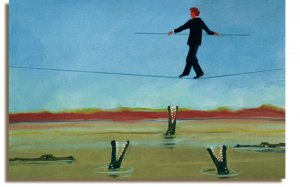

The market has been a meat grinder for the last few months and it has been very difficult to make money or invest. The best course of action was no action at all. Hope you guys have kept your fire power dry. So whichever way the opportunity comes, you will be ready to move.

For now though, I think the opportunity is to the downside.

Thanks for sharing my thoughts.

Odds are increasing for a short play, even I have to agree :) I personally started to sell some credit call spreads in August and probably be buying put spreads and vol in September.

ReplyDeleteBut there is a trick. While everybody is waiting for SPX to reverse, guess what happens in bond world. Well, the bond haven't been able to pull themselfs together recently and they get smashed every day. Not PCLNelined or CMGyed yet, but looks like it's coming :)

Everybody is long bonds. My friends who never ever trade are saying "I'd buy bonds OF COURSE if I had some money to invest". But who's gonna hold the bag? Not retail for sure. Then who left: China, TBTF banks and the Fed? Who is going to blink first among them? :)

Taking into account this 30 years bons bull market, I think that's the place to look right now. Equities are going to be all right long term, and even if they drop 10-15% - that's gonna be an opportunity to buy.

I fully agree with you. The 30 year cycle of bond yield going down is ending this Sept. Next 30 years interest rate will rise even if Ben does not want it. It will crash the bond market.

DeleteBonds are expensive, no doubt, but they can always get more expensive. Equities are not as cheap as most people believe, IMHO. If the projected growth and record profit margins don't hold up, look up below.

DeleteThe recovery since 2008/2009 have largely been financed by public debt(US, China, Europe, and Japan). This is not a sustainable approach.

One final thought, if US equities were so cheap, why aren't the noted value investors(Klarman, Rodriquez, Singer, etc) piling into them?

BB.. Any idea at what point could we see both the bond & equity market both going down together ?... What kind of event would have to play out for such a scenario...Enjoy your blog...John

ReplyDeleteDifficult to predict the future John. If I have a gun on my head to answer the question, I would say sometime in 2013. The seeds have been sown already for the destruction.

DeleteThanks for reading.

My cycle is showing a top around 13-14th August and the upside price ranges have been achieved.

ReplyDeletebecause I have a bearish bias now, to me it looks like a topping process but I could be wrong.

I will now read the article you have mentioned.Sounds interesting.As a liberal Canadian I would like to support the Democrats, but seeing how Obama has double crossed the Ordinary Americans , I am thinking that even Rick Perry would be a better choice.

Obama came on the promise of change, but he is Mr. Statusco and is worse than Carter.

Aug 13-14 alao happens to be monthly opex week. Let time decay eat up value for puts then drop the market.

ReplyDeleteThe market rates are daily up-down. So if you was invested some shares in the market, and your share rates are down in that situation you need to wait for your shares are increasing otherwise you can purchase lowest rates shares. I think, The market has been a meat grinder for the last few months and it has been very difficult to make money or invest. Company Financial Report

ReplyDelete