Readers of the weekly report know by now that short term cycle

has indeed bottomed. But some changes need to be taken into consideration. The

last short term top was due on September 7th, but came on September

14th, about 5 trading days late. The Short term bottom was due on 10th

October but actually came on 12th October. These changes call for adjustments

for future dates.

Earlier I was calling for another short term bottom around October

24th or around that time. With the shift of dates as mentioned above,

I now think that the next short term top will be around October 24th-25th,

instead of a bottom. The expected short term bottom should now move to October

29th- 30th. The final melt- up date remains the same.

From end of October till 12th-14th November.

Getting confused? Well, let me put in another way. A complex topping process is going on. We knew

that this correction was coming and was prepared for it. Now we also know that

another pop is on the way and that would run for next 8-10 days. But that would

not take us far and that is not the final pop. I have written before that we

have one more scare coming. My expectation is that we will see a swing low

around end of October. I cannot say for sure whether that low will be lower

than the current low and that will depend how high this one goes. And please

keep in mind this short term pop will not be one straight line. Talk of

meat grinders!

And a strong caveat: I cannot predict the future. I try

to best guess the market based on certain models. So far most of these calls have been

on track but while anticipating multiple turns in advance, one has to be ready

for quick changes in the plan. I am not playing the market till the end of

October (earlier it was 24th October). And I would not recommend

that anyone does either. Patience is the watch word.

I was little disappointed as to how much gold and silver

sold off but on the other hand these are good entry levels. Silver bounced off

from $32.50 and gold is very close to $ 1740. If you are not already holding

precious metal and planning to take core, long term position, do not jump in

all at once. You must scale in. For e.g. if you are willing to allocate $ 10000

to PM sector, instead of investing the

entire $10K at one shot, do it in 3 or 4 instalments Therefore if tomorrow price

of silver is above $33 (close) and price of gold close above $ 1740, you may

want to allocate 25% -33% to get in. I hope you get my drift. With PMs, we are

talking very long term holding periods. Few years at least. So invest

accordingly.

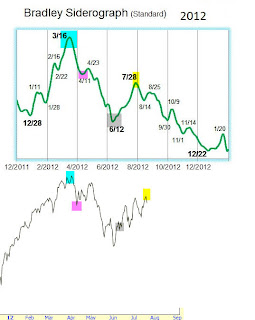

Our dear reader dc_BEAR has sent a Bradley Date chart with a

comparison of actual SPX price movements. The comparison was originally done by

Tim Knights of SOH.

Surprisingly the dates are matching very close to the cycles

which I am working with. Let us see how it plays out but this is eerie.

I know lots of readers here trade short term. One of my friends

called in today and asked me to put in ideas about Options. This is something I

would tell regular investors to stay

away from. I want to emphasize that if you must trade and deal in options, have

separate accounts and allocate only a small amount of risk capital for option

trading. Even if you lose 100% of your option account, which is very likely,

your core investment will not be affected. My friend agreed to my suggestion. If

you folks think that this is something you would like to take a look at, I will

have to start a separate blog on Options. I absolutely would not want

retirement savings going in option play.

I have been pounding the table for “Relaxed Investor”

approach and to take a long term approach to investing for quite a while now. Yesterday,

Josh Brown of The reformed trader wrote the following:

A portfolio

compounding at 7 percent will double in 10.5 years. Thus, if a client has 20

years of working, saving and investing in front of him (and our nemesis

inflation compounds at just 2 to 4% a year) the reality is that we'll be just

fine (even if a bit envious at times of an Icarus trader's good fortune and a

bit smug when they inevitably crash back to earth). Dicking around with small

cap Chinese coal miners just because "they move, bro" simply doesn't

enter into this goal-oriented approach. And once the goals become simple, the

methodology ought to be every bit as simple. I tell people that if I ever start

talking about delta hedging I'm probably high on something and they should fire

me.

I have written the same thing in the last weekly report.

That’s all for tonight. Hope the up momentum is maintained tomorrow.

Please continue with your help and support which is absolutely critical

to keep the blog running. Do remember to disable Adblock. Also please send

your feedback on the weekly report so that I can make necessary changes as per

your needs. Thanks for reading http://bbfinance.blogspot.com/ join

me in Twitter (@bbfinanceblog)for the real time market updates and calls. And if time permits visit and comment on http://artofbetterlife.blogspot.com/

Thanks BB. Good calls as always.

ReplyDeleteThanks my friend. Please send me an email.

DeleteDone, I thought APPL bounced at a very appropriate level today. Looking forward to some more upside as is compatible with your timeline.

DeleteThank you.

DeleteHow can you be an investor and not sell calls against your stocks? Probably the most basic idea about Options for a regular investor yet nobody cares to try.

ReplyDeleteAnd speaking about dicking around small cap miners...

Look at the link below. Sheldon Dong, vice-president of income strategy at TD Waterhouse, is definitely likes to dick around with mining stocks in his RRSP (hopefully not Chinese ones).

http://www.theglobeandmail.com/globe-investor/investment-ideas/portfolio-strategy/how-one-adviser-is-adapting-to-a-low-rate-environment/article2326265/

The amount of bs out there about investing, trading and speculation is just unbelievable. BB, you're giving great and very valuable insight about markets, but avoiding options?! C'mon...

And what's so complicated about delta hedging? You have number of deltas in your portfolio, beta weight it to SPY and hedge it with either long/short SPY, SPY options, option spreads or e-mini futures - all this 5th grade arithmetic. I truly believe an average investor is much smarter than all these advisors and income strategists, like one in theglobeandmail link.

They can't even explain how to adjust delta on a portfolio...

Selling covered calls is not everyone'c cup of tea. You may be finding delta hedging easy, but go explain it to a person in his 40s busy doing other things in life, rather than playing options and whose financial goal is to have sufficient savings for retirement.

DeleteI am not saying avoid options. Do it if you are a trader or can afford to risk your capital. What I am saying is, these instruments are not suitable and best avoided for most investors.

And do it in separate accounts and not mix it up with your savings goal. Trading and long term term investment must be separate.

I myself deal in options often and I plan to start a separate blog on options.

May be I am unable to explain you that goals and roads for the two are different.

Also, we are entering in the twilight zone where just to get your capital back from the market would be great. The primary focus of 99% of the folks out there investing in one form or another would be "Return of Capital". They should not try to be smart or cute. If they cannot understand it in the 1st 10 minutes, they should not try it. Period.

DeleteRoman, please send an email to : bbfinanceblog@gmail.com ASAP.

DeleteIt is about a dedicated blog on options.

Wow ...you were right on the money with Plan A ...impressive!

ReplyDeleteThank you :)That is why we should not chase momentum, whether upside or downside.

DeleteBB...On the subject of options... Why not start building a position with Jan 2014 out of money leaps...

ReplyDeleteAdd to your position only during the rallies and then hold...

Besides trying to day trade or swing trade this rigged market short term is too stressful and not much fun if you are losing money right?...Odds are much better with time on your side...Just let it ride!

planning to start a separate site for options. can you please send me an email.

Delete