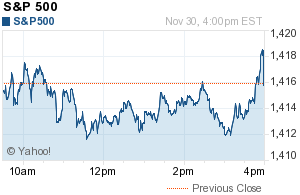

I sometimes write about the Boyz manipulating the market

like a giant casino and you shake your head in utter disbelieve. Nowhere the

manipulation was more evident than the closing market action of Friday. Instead

of me writing something and doing a poor job of it, let me quote from Josh

Brown of Reformed Broker:

Friday's close was the

most obviously, nakedly manipulated bullshit close I've ever seen. I have no

idea who is behind it but this is not what healthy, well-participated-in

markets do. There are too many real players to allow for this kind of thing to

be able to happen in a real market. This market we have is shady as hell. I

wouldn't even comment on something like the below chart if it were a one-off,

but honestly, this feels like it's all the time.

The market is devoid

of width and depth, you can jerk it around pretty easily - especially if backed

by an institution that borrows free money. And in the meantime, the

powers that be need it to close higher every week to prevent outflows and

redemptions.

So let us start with the analysis of what the manipulators

will do next. In a way the markets did what was expected of it, except perhaps

crude but that I consider more of an exception than rule. Next two weeks are going to be interesting.

However do not expect any crash. As I said yesterday, the BOYZ will create some

confusion and panic to buy cheap. ZH will do its best to scare folks in selling

or shorting. Those who think that they can tackle this market with fundamental

analysis or technical analysis alone, they are in for a rude awakening.

Regarding the long term fundamental analysis let me read the

following in Bloomberg:

Bond Investor

Gundlach Buys Stocks, Sees 'Kaboom' Ahead :

Then it goes on to say some more:

The co-founder and

chief executive officer of DoubleLine Capital LP explains that the first phase

of the coming debacle consisted of a 27-year buildup of corporate, personal and

sovereign debt. That lasted until 2008, when unfettered lending finally toppled

banks and pushed the global economy into a recession, spurring governments and

central banks to spend trillions of dollars to stimulate growth, Bloomberg

Markets reports in its January issue.

In the ominous third

phase, he predicts another crisis: Deeply indebted countries and companies,

which Gundlach doesn’t name, will default sometime after 2013. Central banks

may forestall these defaults by pumping even more money into the economy -- at

the risk of higher inflation in coming years.

Gundlach, 53, doesn’t

know when the third phase will get here, but he tells his audience they need to

gradually get ready for it.

“I don’t believe

you’re going to get some sort of an early warning,” Gundlach, who’s also chief

investment officer at Los Angeles-based DoubleLine, tells his listeners. “You

should be moving now.”

For most parts, Gundlach is correct. The part I disagree is; his

call to buy stocks: because when that crisis situation comes, stocks are going

to be equally badly hit. There will not be any hiding place.

However, I do not want to sound like ZH and I do not believe

that we are going to that bust phase right now. We still have some more time

and we should use that time to make money. It is no point to short the market

when it is going up even if the up movement is temporary. While traditional

investment / trading tools are not going to give you the any early warning, the

cycle analysis will and does give us detailed road map in the future.

It is cycle analysis which had told us that this current

correction is just a correction, not a crash and has kept us focused. While 2012 has been a huge chop for most

parts without clear direction, 2013 shows very clear direction. It is much

easier if we know what lies ahead.

The road to financial freedom starts with a little bit of

introspection. Set out your goal. What are you expecting in terms of your

investment? Are you thinking like an investor or trader? If you expect to

double the money every so often with Options, you are gambling and taking huge

risk. What is your risk tolerance level? Risk is the amount of money that you

will lose when you are wrong. And chances are, we will be wrong most of the times.

If anyone says anything else, don’t believe it. The only “Mantra” going to be

risk reduction. I would love to say ‘risk elimination” but we cannot totally

eliminate risk from investing or trading.

With a 10% compound rate of return, you will more than double your money

in 10 years. Does it sound reasonable? If we can do that consistently, we can

retire happy. Then why can’t we achieve it? Because we chase yield and compare

our return with some silly bench mark or against others. We read that there are

wizards out there whose trading methods gives 80% return in every trade and

chase those mirages. We allow green to overcome logical reasoning.

Therefore dear readers, before the crisis moment is upon us,

just do your goal setting. Where you are right now. What you want? Is that goal

reasonable? How much risk you are willing to take. ( How much money you are

ready to lose if you are wrong) Do these exercise seriously before you think of

subscribing my or anybody’s trade/ investment ideas. Nobody can offer any magic

formula. I will probably help you in preservation of capital and grow it in a

reasonable manner. Sometimes I will not trade for months if I think that the

environment is not right. Sometimes I will go in and out of trade quickly if I

see an opportunity. Sometimes I will take a position and sit on it for months

and years. Whatever it is, the magic has to start with you.

This weekend is a good time to start that exercise. Your

financial freedom is in your hand. Take charge of it.

I don't think it's a big deal how market closed at the last day of the month. It would be more surprising if it closed in more "human" way. But there is probably too much cheap money and too many auto trading systems to allow "unpredictable" closes. So ES was exactly 1% up at month end!

ReplyDeleteThat's why your writing is good, BB. Investors and even traders shouldn't be fixated on this too much. To be aware - yes, and take into account this info to make long- and medium term decisions.

I wanted to share one chart: spy with aud.jpy

http://tinyurl.com/caehrwd

These two will definitely meet each other :)

Yes, be aware and prepared.

ReplyDeleteBB - you left out a part of the comment that I've been very frustrated with -- the gaps in the morning of which most of the money is made without the retail investor. Before you can even get in, the train most often has left the station. I am trying to zoom out and focus more on weekly charts to look for longer term trends and ride those instead - very hard to do since as an investor, patience is key.

ReplyDeleteO, I fully agree with you and I have written that many times in the past.

DeleteYou will see worst chop in December when Day Traders will be killed like flies. Patience is going to be the key and need to keep reminding ourselves that we do not have to chase everything that moves.

HFT Algos are ruling the day! There is a new movie coming out that explores this topic and sheds some light on the dark side. Have a look at the trailer. It looks fascinating and explains a lot.

ReplyDeletehttp://ghostexchangemovie.com/