Apple dropped almost 7% out of nowhere and SPX reversed

hard. What gives?

This is not a market for faint hearted that’s for sure.

If we are able to look beyond equities, we will find that

there were lots of actions today in the commodities.

Let's start with the US Dollar Index daily chart.

I think it made a bottom. If my thinking and analysis are right, we will see more pressure on crude and PM sector soon.

Gold and Silver gave the sell signal and I plan to add some

more to my short silver position. I

would have liked silver to close around $ 32.50 range and that would have made

me more comfortable with the shorts, but none-the-less, there is no higher

price target for PMs now. The direction is clearly lower.

Few days back I wrote that I am out of Nat. Gas. There was a question as to

how low I expect Nat.Gas to go and I wrote that I do not have any lower

price target for Nat. Gas and I am neutral. I also wrote that Nat. Gas would

most likely test the falling trend line around $ 3.90 and only when it fails

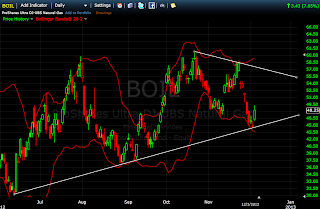

there, it would be safe to short it. Nat. Gas jumped 4% out of nowhere. The 2X

ETF BOIL tells a story.

I would expect BOIL to test $ 56 level and fail there. That

would be a cue to take a short trade in Nat. Gas.

I also wrote about coffee few days back. I said that the

hourly charts of coffee is over bought and will retrace soon. It is where that

retracement stops will determine if Coffee has really bottomed. From the

hourly chart of coffee ETF (JO) it seems that it has made a double or triple bottom.

I do not want to jump in coffee yet.

Let us keep an eye on the daily chart of JO and we can think

of a safe entry when the 13 DMA crosses over the 34 DMA. I think that would be

around $ 35 or so.

Equities are moving in

a world of their own. No one wants to sell because everyone is expecting a deal

on the fiscal cliff. This, despite the

best efforts of CNBC to scare the retail to sell. So the Boyz will now have to

take drastic step and create a bit of panic. I have been writing that do not

expect any big sell off, keep the stops tight etc. etc. If we do not get the

sell-off by next week, I might close my short positions of the indices and just

continue with the short position on crude and silver. I am not suggesting to go long yet but keep

an worry eye on any short on equities. I feel bad bad for ZH, the world refuses

to collapse. May be a bad NFP number tomorrow will convince folks to sell and

that would be a good excuse to create some panic.

Yep, the equity markets have been holding up pretty well, perhaps tomorrow's NFP will do the trick.

ReplyDeletePeople are speculating about QE4 during the next FOMC, any thoughts?

I don't think there will be any more QE. QE infinity is going on.

DeleteOne more idea into commodities pile: wheat (ZW on tos). It's up at a very long declining line in a symmetrical triangle. I think anything near 850-900 is a sale (I use march contract).

ReplyDeleteAlso oil touched rising trend-line 3 times, around 90$. There is kind of a bear flag formed which is going to break sometime soon.

I think jan calls on vix gonna be in demand if vix gets down to 15.5-16

Yeah, it's very noticeable how indicies refuse to go lower. But they continue to weaken by refusing to do so. Lots of folks, including myseld, were forced to cover shorts for the last 8-10 sessions. So there is not much left underneath.

And hey - nobody wanted to sell apple 3 days ago and look what happened. This thing has lost 80% of entire s&p 500 cap in one day, if zh told us correctly. And the same time ES reverses 20 points and closes green?! I mean whom you gonna believe: SPX +.16% or Apple with -6.5%?

As you know, I am short OIL, SILVER and Indices. I will be closing some of the shorts on Indices and add to short silver trade.

DeleteWheat cycle has not bottomed yet. It is in my radar screen.

I would not recommend trading in VIX or any of its cousins except XIV but even that is not now.

Could you explain what product you use to short and WHY. There are so may and I am curious what criteria you use to pick which one to go with. Volume, technicals, volitility....

DeleteThanks.

The taste of the cake is in eating. Judging by the trades that I take, suggest, I would consider the cake really tasty.

DeleteWhen you are getting a tasty cake free, why do you want to know the recipe?

How I arrive at a particular trade is my trademark. I have spent years writing and perfecting the Algo. Just today morning, I sent out a tweet that I am closing my short position in Indices. After I closed, the Indices went up. Had I stayed with the short positions, it would have been under water. What I saw and why I did it is my little secret.

So for now, enjoy the free stuff.