Calling “top” and “Bottom” is a losing game but if we are

playing the game without any skin in it, then it is fun. We closed our short

position on the indices in the nick of time and we are only short on two

commodities as mentioned in the Sunday newsletter. So we can afford to call a top in equities

and even if we are wrong, no harm done.

In the Sunday newsletter, I mentioned that I was expecting

NDX to test 2700 level in a few days

time. Sure enough NDX came up to 2697 intra-day. With that we have covered 50%

Fib. retracement level. Now let us see how tomorrow morning plays out and

whether I feel comfy to dip my toe in SQQQ.

For one thing, I absolutely do not like the price action of Apple and I

think it is going to make a lower low. And with that NDX should also make a

lower low.

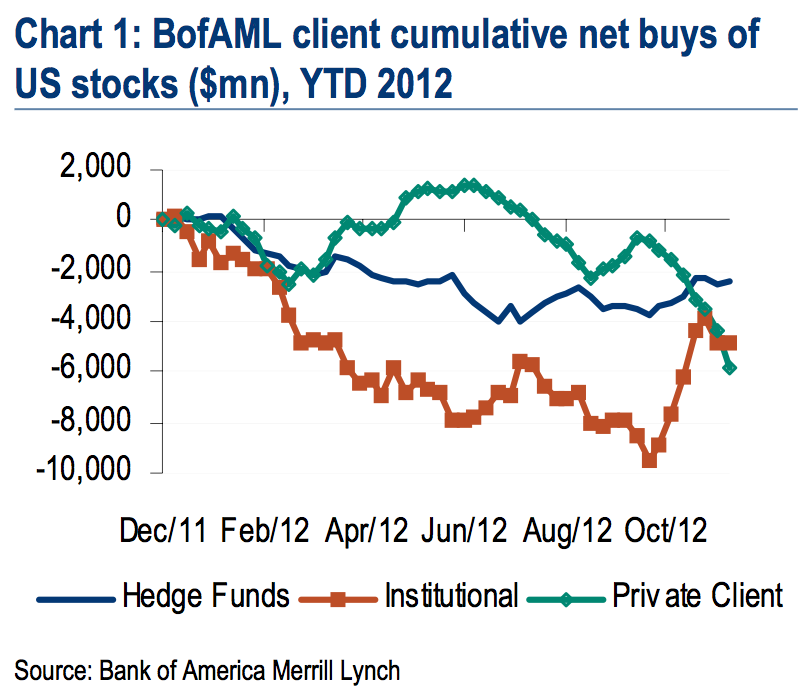

Let us be absolutely clear that the end of the world is not

anywhere close and we are in a corrective phase. As of now that correction is incomplete. CNBC and

ZH do their best to scare retail investors to sell with various types of scare

and the latest of the scare is the scare of the Fiscal Cliff. And while retail

is selling, guess who is buying?

It is the Institutions. It never fails!

I am not saying we have to buy here. Rather I have suggested

that we should reduce our exposure to equities and keep cash ready for a better

entry. I am not comfortable with the

risk reward equation of equities and that is why I am on the sideline and I

really do not mind even if I miss a good selling in equities here. Because I

see opportunities in other assets classes which are less risky to me. I am all about reducing risk in investment /

trading and less about making double quick money.

It is important to

remember that when people say “…you can’t make money without taking a risk”

what they are really mean is “you can make a lot of money if you right – but

likely lose a lot more if you are wrong.” Since every investment decision is

primarily a 50/50 bet you can see why being an aggressive investor has worked

out so poorly for individuals over time.

For tomorrow, I would like the indices to close in green

because that will push the McClellan Oscillator in the overbought territory.

If I think there is a trade worth taking tomorrow, I will

email everyone. Short term, we are not out of the woods and most likely selling

will resume soon. I just don’t want to front run.

Thanks for reading the blog.

Wof - thanks very much for sharing your analysis and insights.

ReplyDelete